How to File Your Beneficial Ownership Information Report: A Complete 2026 Guide

The Corporate Transparency Act (CTA) has fundamentally changed how businesses operate in the United States. If you own or operate a company, understanding and complying with the Beneficial Ownership Information (BOI) reporting requirements isn't just important—it's legally mandatory. This federal filing requirement, established under the Corporate Transparency Act, aims to prevent money laundering, tax fraud, and other illicit activities by requiring businesses to disclose who actually owns and controls them.

Updated for 2026: The Corporate Transparency Act regulations have undergone significant changes. As of March 2025, all U.S. domestic companies are now exempt from BOI reporting requirements. However, foreign companies registered to do business in the United States must still comply with filing requirements.

The Beneficial Ownership Information (BOI) reporting requirement represents one of the most significant regulatory changes affecting businesses in recent years. Enacted as part of the Corporate Transparency Act (CTA) in 2021, these regulations were designed to combat money laundering, terrorist financing, and other illicit activities by increasing transparency in corporate ownership structures.

What Is a Beneficial Ownership Information Report?

A Beneficial Ownership Information report is a filing that discloses the individuals who ultimately own or control a company. This is a federal filing requirement designed to combat money laundering, tax fraud, and other illicit activities by increasing transparency around company ownership. The Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury, collects this information to create a national database that law enforcement and regulatory agencies can access.

The BOI report requires companies to identify their "beneficial owners"—individuals who either own at least 25% of the company or exercise substantial control over it.

At its core, the BOI report requires companies to disclose who actually owns and controls them. This means identifying the real people behind the business entity, not just the company name on the paperwork.

Who Needs to File?

Most corporations, limited liability companies (LLCs), and similar entities created in the United States or registered to do business in the U.S. must file a BOI report. This includes both domestic and foreign entities.

Entities Required to File:

Corporations

Limited liability companies (LLCs)

Limited partnerships

Limited liability partnerships (LLPs)

Business trusts

Most other entities created by filing with a state office

Major Update: Who Must File in 2026

In a significant policy shift announced in March 2025, the Financial Crimes Enforcement Network (FinCEN) issued an interim final rule that dramatically changed the scope of BOI reporting requirements. This change has fundamentally altered the compliance landscape for businesses operating in the United States.

Critical Change: As of March 26, 2025, all domestic companies created in the United States are exempt from BOI reporting requirements. Only foreign companies registered to do business in the U.S. must now file reports with FinCEN.

Who Is Now Exempt

The following entities are no longer required to file BOI reports:

All U.S. Domestic Companies: Any corporation, LLC, or other entity created by filing documents with a U.S. state or tribal jurisdiction

U.S. Beneficial Owners: U.S. persons are exempt from providing BOI regardless of which reporting company they're associated with

Previously Filed Domestic Companies: Domestic companies that already filed BOI reports are not required to update or correct those reports

Who Must Still File

Foreign reporting companies remain subject to BOI filing requirements if they meet these criteria:

The entity was formed under the laws of a foreign country

The entity has registered to do business in any U.S. state or tribal jurisdiction

Registration was accomplished by filing a document with a secretary of state or similar office

The entity does not qualify for one of the 23 statutory exemptions

Understanding the 23 Exemptions

Even foreign companies may be exempt from BOI reporting if they fall into one of these 23 categories:

Common Exemptions Include:

Securities Reporting Issuer: Companies already reporting to the SEC

Governmental Authority: Federal, state, local, or tribal government entities

Banks and Credit Unions: Federally regulated financial institutions

Large Operating Company: Companies with more than 20 full-time U.S. employees, over $5 million in gross receipts or sales, and a physical U.S. office

Subsidiary of Exempt Entity: Entities wholly owned or controlled by exempt companies

Insurance Company: State-licensed insurance providers

Accounting Firm: Public accounting firms registered under federal law

Public Utility: Entities providing utility services to the general public

Pooled Investment Vehicle: Investment companies and advisers

Tax-Exempt Entity: Organizations exempt from federal income tax under specific IRS codes

Who Are Beneficial Owners?

A beneficial owner is any individual who either directly or indirectly exercises substantial control over the company or owns or controls at least 25% of the company's ownership interests.

Substantial Control

An individual exercises substantial control over a reporting company if they:

Serve as a senior officer (President, CFO, CEO, COO, General Counsel, or equivalent)

Have authority to appoint or remove senior officers or a majority of the board

Direct, determine, or have substantial influence over important company decisions

Have any other form of substantial control over the company

Ownership Interest

Ownership or control of at least 25% of the company's ownership interests includes:

Equity, stock, or voting rights

Capital or profits interests

Convertible instruments

Options or privileges to acquire ownership interests

Any other mechanism establishing ownership

Important Note: Ownership can be direct or indirect through intermediary entities, contracts, arrangements, or other relationships. FinCEN takes a broad view to prevent loopholes that could obscure true ownership.

Most companies will need to report between one and four beneficial owners, though some may have more depending on their ownership structure.

What About Company Applicants?

For companies formed on or after January 1, 2024, you must also report information about company applicants. These are the individuals who directly filed the document creating the company or were primarily responsible for directing or controlling that filing.

Typically, this includes the person who physically submitted the formation documents and, if different, the attorney or service provider who prepared them. Companies formed before 2024 don't need to report company applicant information.

What Information Must Be Reported?

For each beneficial owner and company applicant (if applicable), you'll need to provide:

Full legal name

Date of birth

Current residential or business address (P.O. boxes are not acceptable)

A unique identifying number from an acceptable identification document

An image of that identification document

Acceptable forms of identification include:

U.S. passport

State driver's license

State or local identification card

Foreign passport (for non-U.S. persons)

For the company itself, you'll report:

Legal name and any trade names or DBAs

Current street address of the principal place of business

Jurisdiction of formation or registration

Taxpayer Identification Number (EIN)

Understanding FinCEN Identifiers

To simplify reporting, FinCEN offers a FinCEN Identifier—a unique number that can be used instead of repeatedly submitting the same personal information. Individuals can apply for their own FinCEN Identifier by submitting their information directly to FinCEN. Once obtained, this identifier can be used across multiple BOI reports.

This is particularly useful for individuals who own or control multiple companies, as they can simply provide their FinCEN Identifier rather than uploading identification documents for each report.

Filing Deadlines for 2026

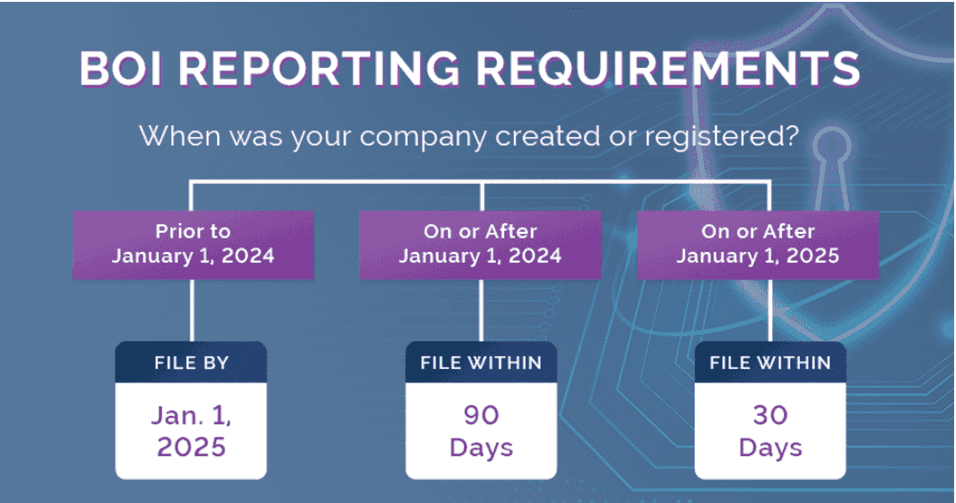

The filing deadline depends on when your company was created or registered:

Companies formed before January 1, 2024: Had until January 1, 2025 to file their initial report.

Companies formed during 2024: Had 90 calendar days from formation or registration to file.

Companies formed on or after January 1, 2025: Have 30 calendar days from formation or registration to file their initial BOI report.

These shortened deadlines mean new business owners must act quickly. Missing the deadline can result in significant penalties.

A beneficial owner is someone who either directly or indirectly owns or controls at least 25% of the ownership interests, or exercises substantial control over the reporting company.

If you've already filed your initial report, you're required to update it within 30 days if there are any changes to the information previously submitted, such as a change in beneficial ownership or a change in a beneficial owner's address.

Acceptable Identification Documents

For non-U.S. persons who are beneficial owners of foreign reporting companies, acceptable identification includes:

Document Type | Requirements |

|---|---|

Foreign Passport | Must be current and unexpired |

National ID Card | Must be issued by a foreign government with photo |

Foreign Driver's License | Must be current and unexpired |

Remember: U.S. persons are no longer required to be reported as beneficial owners of any reporting company, even foreign ones. Only report non-U.S. persons who meet the beneficial owner criteria.

How to File Your BOI Report

Step-by-Step Filing Process

Filing your BOI report is a straightforward process when you're properly prepared. Follow these steps to ensure successful submission:

Step 1: Gather Required Information

Before beginning the filing process, compile all necessary documents and information. Create a secure file with identification documents, company formation documents, and beneficial owner details. This preparation will make the actual filing process much smoother.

Step 2: Access the FinCEN Portal

Visit the official FinCEN BOI E-Filing website at boiefiling.fincen.gov. This is a secure, government website where all BOI reports must be filed. The filing system is free to use, and FinCEN never charges fees or sends payment requests.

Beware of Scams: FinCEN does not send emails or letters requesting payment for BOI filing. Any correspondence asking for money or containing suspicious links is fraudulent. Only use the official government website.

Step 3: Complete the Online Form

The online form will guide you through entering company information and beneficial owner details. Take your time to ensure accuracy, as errors may require corrections later. The system allows you to save your progress if you need to step away.

Step 4: Upload Identification Documents

For each beneficial owner, you'll need to upload a clear, legible image of their identification document. Accepted formats typically include PDF, JPG, or PNG files. Ensure documents are not expired and images are high quality.

Step 5: Review and Submit

Carefully review all entered information before submission. Once submitted, you'll receive a confirmation. Save this confirmation for your records, as it provides proof of timely filing.

Using FinCEN Identifiers

FinCEN offers a useful tool called a FinCEN Identifier that can simplify the reporting process, especially for individuals who are beneficial owners of multiple companies.

Benefits of FinCEN Identifiers:

Individuals can obtain a unique FinCEN ID by providing their personal information once

Reporting companies can use this ID number instead of repeatedly submitting the individual's personal information

Updates to personal information only need to be made once through the FinCEN ID system

Provides an additional layer of privacy protection

To obtain a FinCEN Identifier, individuals must submit their beneficial owner information directly to FinCEN. Once approved, they'll receive a unique identification number that can be shared with reporting companies.

Updating Your BOI Report

BOI reporting is not a one-time requirement. Foreign reporting companies must file updated reports within 30 days of any change to previously reported information.

Common Triggers for Updates:

Change in beneficial ownership (new owners or owners crossing the 25% threshold)

Change in company name or address

Beneficial owner moves to a new address

Beneficial owner obtains a new identification document

Changes in who exercises substantial control

Grace Period: If you discover an error in your initial report, you have 90 days from the original filing deadline to correct it without facing penalties. However, this grace period only applies to inadvertent mistakes, not willful violations.

Penalties for Non-Compliance

The consequences for failing to comply with BOI reporting requirements are severe. Understanding these penalties emphasizes the importance of timely and accurate filing.

Civil Penalties

Companies that fail to file required reports or provide false information may face civil penalties of up to $500 for each day the violation continues. These penalties can accumulate quickly, resulting in substantial financial liability.

Criminal Penalties

Willful violations of BOI reporting requirements can result in criminal charges, including:

Fines up to $10,000

Imprisonment for up to two years

Or both fine and imprisonment

Important: Senior officers of reporting companies can be held personally liable for willful failures to report complete or updated beneficial ownership information. This personal liability extends beyond just the company itself.

Special Situations and Considerations

Trusts and Complex Ownership Structures: If your company is owned through trusts or multiple layers of entities, determining beneficial owners can be complex. You'll need to trace ownership through intermediary entities to identify the ultimate individual owners or controllers.

Multiple Companies: If you own several companies, each entity must file its own separate BOI report. Using FinCEN Identifiers can streamline this process significantly.

Foreign Owners: Non-U.S. persons who are beneficial owners must still be reported using their foreign passport or other acceptable identification.

Deceased Beneficial Owners: If a beneficial owner passes away, you must update the report within 30 days to reflect the change in ownership or control.

Special Considerations for 2026

State-Level Requirements

While federal BOI requirements now only apply to foreign companies, some states have implemented their own transparency laws. New York's LLC Transparency Act, for example, takes effect January 1, 2026, and requires all LLCs formed or registered in New York to file beneficial ownership information with the New York Department of State.

Businesses operating in multiple states should research whether additional state-level reporting requirements apply to them, as these requirements exist independently of federal FinCEN rules.

Ongoing Legal Challenges

The CTA has faced constitutional challenges in federal courts, with some courts issuing injunctions against enforcement. However, as of December 2025, the exemption of domestic companies remains in effect, and foreign reporting companies must continue to comply with filing requirements.

Businesses should stay informed about legal developments, as future court decisions could impact reporting obligations.

Best Practices for Compliance

To ensure smooth compliance with BOI reporting requirements, consider implementing these best practices:

✓ Maintain Accurate Records: Keep detailed ownership and control documentation

✓ Establish Internal Processes: Create procedures for identifying changes that trigger update requirements

✓ Designate Responsibility: Assign specific personnel to manage BOI compliance

✓ Set Calendar Reminders: Mark important deadlines well in advance

✓ Document Everything: Save confirmation notices and maintain a compliance file

✓ Review Regularly: Periodically verify that your beneficial owner information remains current

✓ Consult Professionals: When in doubt, seek guidance from attorneys or compliance specialists

Resources and Support

FinCEN provides numerous resources to help reporting companies understand and comply with BOI requirements:

Small Entity Compliance Guide: Comprehensive guide with examples and flowcharts

FAQs: Answers to hundreds of common questions

Webinars and Videos: Educational content explaining various aspects of reporting

Contact Center: Support line for specific questions: 1-866-346-9478

Official Website: www.fincen.gov/boi for all BOI-related information

While FinCEN cannot provide legal advice, their support resources can help clarify technical questions about the filing process.

Conclusion

The landscape of beneficial ownership reporting has undergone dramatic changes in 2025 and 2026. While domestic U.S. companies now enjoy an exemption from federal BOI reporting, foreign companies registered to do business in the United States must remain vigilant about their compliance obligations.

Understanding whether your company must file, gathering the required information, and submitting accurate reports on time are essential steps to avoid significant penalties. The 30-day window for foreign companies registered after March 26, 2025, and the April 25, 2025, deadline for previously registered companies leave little room for delay.

By following this guide, utilizing available resources, and establishing robust compliance procedures, foreign companies can navigate the BOI reporting requirements successfully. Remember that this is not a one-time filing—ongoing monitoring and timely updates are critical components of maintaining compliance.

If you're uncertain about whether your company needs to file—or how to do it correctly—FinOpSys can help you confirm your BOI obligations and complete your filing accurately and on time, so you avoid costly penalties and stay fully compliant.

Share blog: