Fixed Expenses vs Variable Expenses: What Every Business Should Know

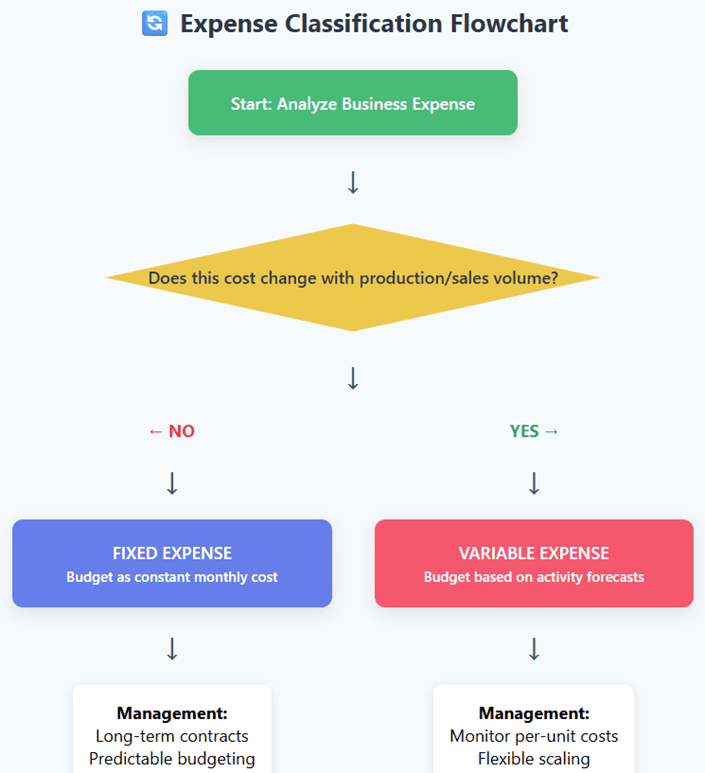

Understanding the difference between fixed and variable expenses is fundamental to running a successful business. Whether you're launching a startup or managing an established company, knowing how these costs behave can mean the difference between profitability and financial struggle.

What Are Fixed Expenses?

Fixed expenses are costs that remain constant regardless of your business activity level. These expenses don't fluctuate with production volume, sales, or service delivery. You'll pay the same amount whether you have zero customers or a hundred.

Common Examples of Fixed Expenses

Rent and Lease Payments: Your office, warehouse, or retail space costs the same each month regardless of how much business you conduct.

Salaries: Full-time employee salaries remain consistent, unlike hourly wages or commission-based pay.

Insurance Premiums: Business insurance, liability coverage, and property insurance typically have fixed annual or monthly costs.

Loan Payments: Principal and interest payments on business loans stay the same throughout the term.

Software Subscriptions: Most business software operates on fixed monthly or annual subscription models.

Depreciation: The scheduled depreciation of equipment and assets remains constant over time.

What Are Variable Expenses?

Variable expenses fluctuate in direct proportion to your business activity. As production increases, these costs rise. When business slows down, they decrease accordingly.

Common Examples of Variable Expenses

Raw Materials: Manufacturing businesses pay more for materials as they produce more units.

Direct Labor: Hourly wages, overtime pay, and temporary workers scale with production demands.

Shipping and Delivery: Costs increase with the volume of products shipped to customers.

Commission-Based Pay: Sales commissions rise and fall with revenue performance.

Packaging Supplies: More products sold means more packaging materials needed.

Transaction Fees: Credit card processing fees and payment gateway charges vary with sales volume.

Utilities (Partially Variable): While some utility costs are fixed, production-related electricity and water usage often varies with output.

Key Differences Between Fixed and Variable Expenses

Category | Fixed Expenses | Variable Expenses |

|---|---|---|

Dependence on sales volume | Stay constant | Fluctuate with sales or production |

Budget predictability | Easy to forecast | Harder to predict |

Flexibility | Less flexible | Highly flexible |

Examples | Rent, insurance, salaries | Raw materials, commissions, shipping |

Impact on break-even point | Higher fixed costs mean higher break-even | Lower fixed costs mean faster profitability |

Notice: Fixed costs remain constant while variable costs change with production volume

Why This Distinction Matters

Break-Even Analysis

Understanding your fixed and variable costs is essential for calculating your break-even point—the sales volume where total revenue equals total costs. This calculation helps you determine the minimum sales needed to avoid losses.

Break-Even Formula - Break-Even Point = Fixed Costs ÷ (Price per Unit - Variable Cost per Unit)

Pricing Strategy

Your cost structure directly impacts pricing decisions. Businesses with high fixed costs need sufficient volume to spread those costs across many units, while those with high variable costs must carefully price each unit to ensure profitability.

Profit Margins

Once you cover fixed expenses, additional sales primarily incur variable costs, meaning your profit margin improves with scale. This is why many businesses become more profitable as they grow.

Financial Forecasting

Accurate forecasting requires understanding how costs will behave under different scenarios. Fixed costs provide stability in projections, while variable costs need adjustment based on expected activity levels.

Cash Flow Management

Fixed expenses create predictable cash outflows, making them easier to budget for but also less flexible during slow periods. Variable expenses offer more flexibility but require careful monitoring.

Semi-Variable Expenses: The Middle Ground

Some expenses don't fit neatly into either category. These semi-variable or mixed expenses have both fixed and variable components.

Examples include:

Utilities with a base charge plus usage fees

Salaried employees with performance bonuses

Phone plans with base rates and overage charges

Vehicle expenses with fixed insurance and variable fuel costs

For analysis purposes, break these expenses into their fixed and variable components.

Key Takeaways for Business Owners

Track Both Types: Maintain separate records of fixed and variable expenses for accurate financial analysis

Reduce Fixed Costs When Possible: Consider outsourcing or flexible arrangements to convert fixed costs to variable

Monitor Variable Costs: Look for economies of scale and negotiate better rates with suppliers

Plan for Growth: Understand how costs will change as your business scales

Regular Reviews: Conduct quarterly expense reviews to identify cost-saving opportunities

Use Technology: Implement accounting software to automatically categorize and track expenses

Strategies for Managing Each Type

Managing Fixed Expenses

Negotiate Long-Term Contracts: Lock in favorable rates for rent, insurance, and services to prevent unexpected increases.

Evaluate Necessity: Regularly review fixed expenses to ensure they're still essential to operations.

Consider Outsourcing: Convert fixed costs like full-time salaries into variable costs through contractors or temporary staff.

Sublease Unused Space: If you're paying for more space than needed, subletting can offset fixed rent costs.

Managing Variable Expenses

Build Supplier Relationships: Negotiate volume discounts and favorable payment terms with suppliers.

Implement Inventory Management: Reduce waste and optimize ordering to control material costs.

Monitor Efficiency: Track productivity to ensure variable costs remain proportional to output.

Optimize Operations: Streamline processes to reduce material waste and labor hours.

Plan for Seasonality: If your business has seasonal fluctuations, prepare for periods when variable costs spike or drop.

The Impact on Business Scalability

Your mix of fixed versus variable expenses significantly affects how your business scales.

· High Fixed Costs, Low Variable Costs: This structure (common in software companies) means high initial investment but excellent scalability. Once you break even, additional customers are highly profitable.

· Low Fixed Costs, High Variable Costs: This structure (common in service businesses) requires less upfront investment but makes each new customer less profitable since costs rise proportionally.

Understanding your cost structure helps you make strategic decisions about growth, investment, and resource allocation.

Making Informed Business Decisions

Every business decision should consider its impact on both fixed and variable expenses. When evaluating opportunities, ask yourself:

Will this increase fixed costs, creating ongoing obligations?

Can variable costs be controlled as the business scales?

What's the break-even point with this new cost structure?

How will this affect cash flow in slow periods?

The Bottom Line

Mastering the distinction between fixed and variable expenses empowers you to make smarter financial decisions. Track both categories meticulously, understand how they interact with revenue, and use this knowledge to build a more resilient and profitable business. Whether you're planning for expansion or navigating a difficult period, this knowledge will serve as your financial compass.

Remember, there's no universally "better" cost structure—the ideal mix depends on your industry, growth stage, and business model. The key is understanding what you have and managing it effectively.

Ready to take control of your business finances? Partner with FinOpSys to streamline your expense management and build a smarter, more profitable operation.

Share blog: